TRUE or FALSE: My credit score will drop after bankruptcy?

FALSE! There is a wide misconception that all bankruptcies actually cause a big credit score drop upon filing. The truth is that many people see a huge rise in their credit score following a bankruptcy.

FALSE! There is a wide misconception that all bankruptcies actually cause a big credit score drop upon filing. The truth is that many people see a huge rise in their credit score following a bankruptcy.

The reality is that many clients who need to file bankruptcy have such a negative payment history, opened delinquent accounts, foreclosures and repossession on their credit history, that the bankruptcy discharge actually breathes life into their FICO credit score. While it’s true that you should not expect an immediately high score following bankruptcy, if you manage your credit optimally, you can be looking at a 700 score or higher, as soon as 15 months after your bankruptcy discharge.

To maintain your good credit after bankruptcy, you need to be on time and consistent with any new debts or payments, maintain balances under 25% and rebuild your credit with a secured credit card or the like.

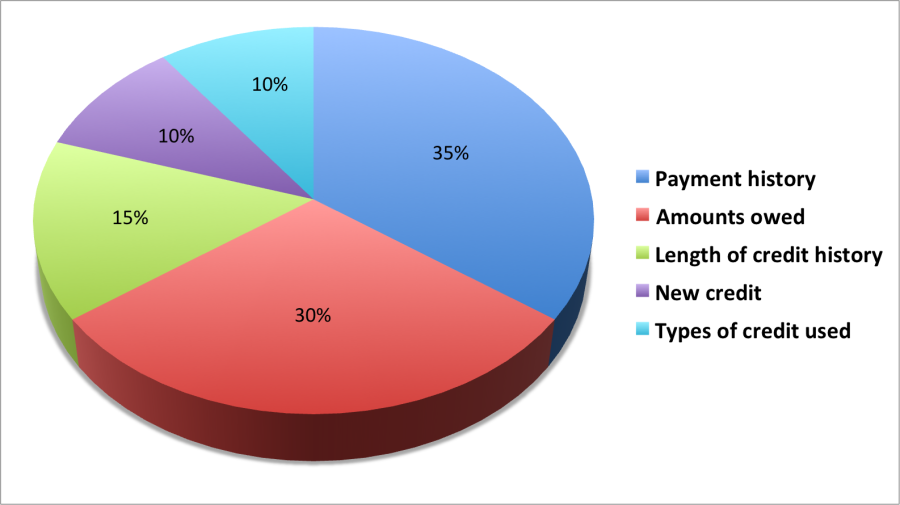

FICO states that your payment history makes up 35

% of your total credit score. It is possible that a bankruptcy filing will not cause a major drop if you already have an inconsistent payment history. Another 30% of your score is the total amount of debt that you owe, which a bankruptcy discharge can actually help reduce since you are eliminating most, if not all of your debts.

The type of bankruptcy you choose to file will determine how long it is listed on your credit report. Chapter 7 and Chapter 11 bankruptcies stay on your credit report for

10 years and Chapter 13 bankruptcies remain on a credit report for seven years after the bankruptcy is completed, the same as a foreclosure or repossession may stay.

While some lenders do not grant credit to anyone with a bankruptcy on their record and others make you wait 2 to 5 years after bankruptcy to obtain credit, most people will find that they can’t get the financing needed anyways due to the poor credit history. Bankruptcy is often the best option for a “fresh start.”